Risk-Guard™ is a set of algorithms and an established process to determine when your TSP account should be in “risk on” mode, meaning that it is in growth orientated stock indexed funds (C, S, or I Funds), or it is in “risk off” mode and invested in the defensive G Fund.

Risk-Guard™ has three levels of algorithms that are used when managing risk for your TSP account. These three phases tell us whether we are fully invested in the market or are in a defensive position. The underlying premise is that up-trending markets tend to have lower volatility and that is when you want to stay invested for as long as possible.

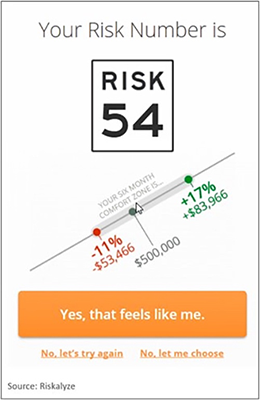

Understanding Your Risk Number:

A major mistake many investors make is when the markets pull back, they sell to protect their account and lock in losses. Further, some investors will continue to sit out of the recovery (for example, leaving everything in the G Fund) and wait until they feel comfortable before investing again. Usually when the market hits it’s next high, they get back in. Emotionally driven decisions create a buy high - sell low investment strategy. There’s a Better Way.

Risk-Guard and Riskalyze:

A key component of the Risk-Guard™ process is a risk analysis tool called, Riskalyze. The Risk Number and corresponding risk/reward range (comfort zone) allows you to quantify your level of risk. Most risk tolerance tests are very subjective and do a poor job of accurately pinpointing your appetite for risk. With Riskalyze you are empowered by transparent, objective, well-defined, actionable expectations. The probability of success is quantifiable, not emotional.

Here's how it works:

Risk On – Market is relatively calm. Your TSP account is fully invested in the market with equity exposure in the stock indexed funds (C, S, and I Funds).

Risk Watch – Market is experiencing volatility and uncertainty. The “risk watch” signal has tripped, but not enough to go into full risk off mode. We remain fully invested in the markets, but system alert levels are higher.

Risk Off – Market is experiencing heightened volatility. Signal wire is tripped prompting defensive changes to the allocations in your TSP account. We only move to “risk off” mode when our trend signals reveal a potential, significant and prolonged market downturn.